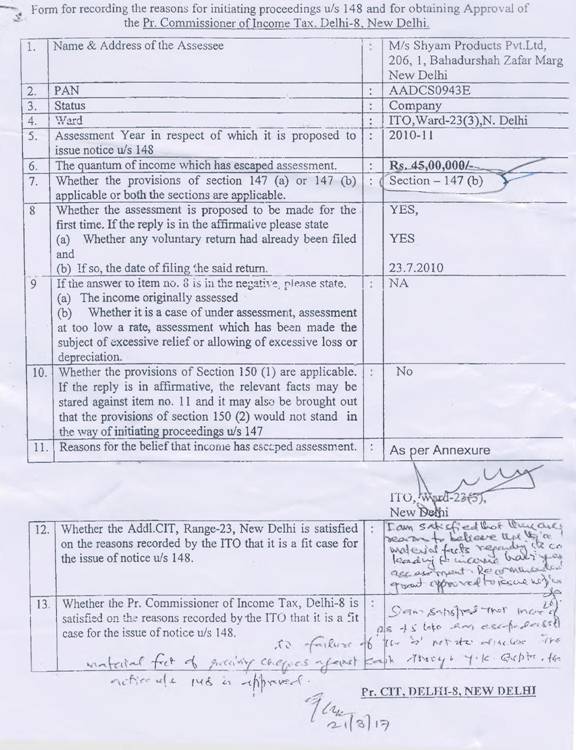

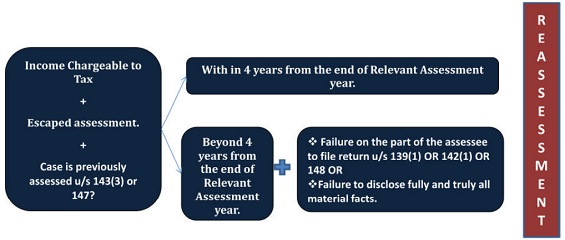

Reassessment & Revision - Paradigm Shift under the Income Tax Act, 1961 intro 27th April, 2018 Baroda Branch of ICAI CA Virat A Bhavsar - ppt download

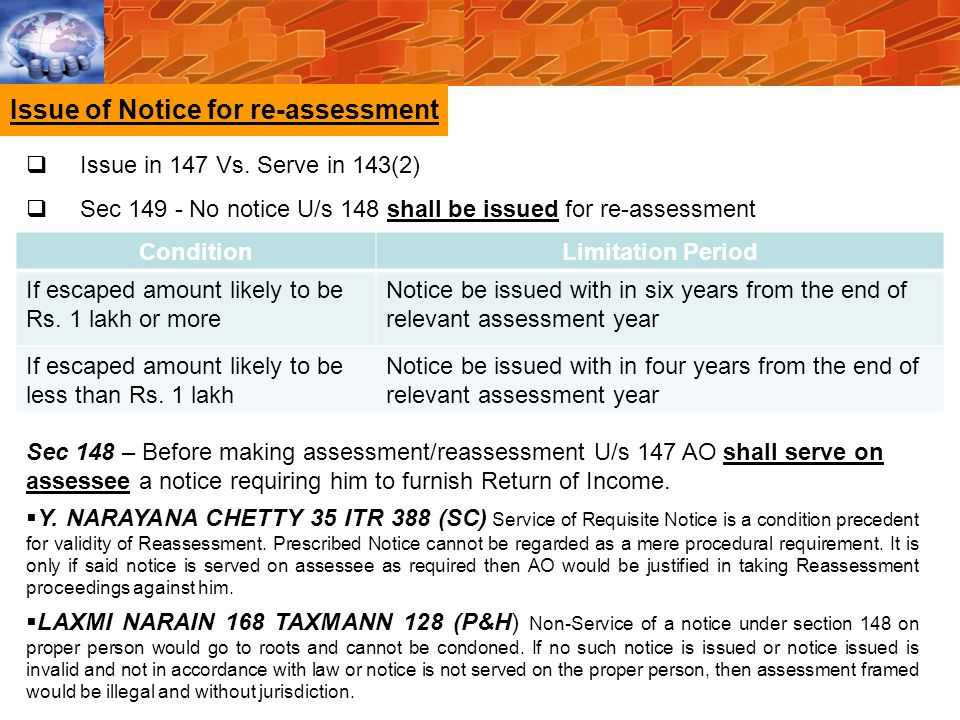

If there is no valid service of notice, section 147 assessment proceedings are invalid - Faceless Compliance

Section 147 – Advance Tax paid by the taxpayer - KK Consultant - Consultancy Firm Rawalpindi - Islamabad - Pakistan

![Taxmann - #IncomeTax Update! Paradigm Shift in the Law of Re-assessments Topics Covered in this Article: • New Scheme of Re-Assessment • Completion of Re-Assessment [Section 147] • Issue of Notice for Taxmann - #IncomeTax Update! Paradigm Shift in the Law of Re-assessments Topics Covered in this Article: • New Scheme of Re-Assessment • Completion of Re-Assessment [Section 147] • Issue of Notice for](https://lookaside.fbsbx.com/lookaside/crawler/media/?media_id=10164887101750644)